Payment Processing with Biometrics within Metaverse

Payment Online integrated transaction processing platform with biometrics is inteded to revolutionize ecommerce by offering a secure, frictionless, and immersive payment experience. In the metaverse, where virtual and real worlds blend, biometric authentication methods such as facial recognition, voice recognition, and fingerprint scanning can be seamlessly integrated into virtual reality (VR) and augmented reality (AR) environments.

Online shoppers can make purchases within the metaverse simply by using their biometric data, eliminating the need for traditional payment methods like credit cards. This not only enhances security by ensuring that only authorized users can make transactions but also provides a highly convenient and natural way to pay, enhancing the overall user experience.

Additionally, biometric payment processing in the metaverse can be tailored to individual avatars, making transactions more personalized and user-centric. As ecommerce businesses expand their presence into virtual spaces, adopting biometric payment solutions within the metaverse will be essential for building trust, ensuring security, and driving the future of online commerce.

The integration of biometrics and the metaverse into ecommerce and payment processing holds enormous potential for shaping the future of digital transactions, enhancing security, and providing immersive shopping experiences.

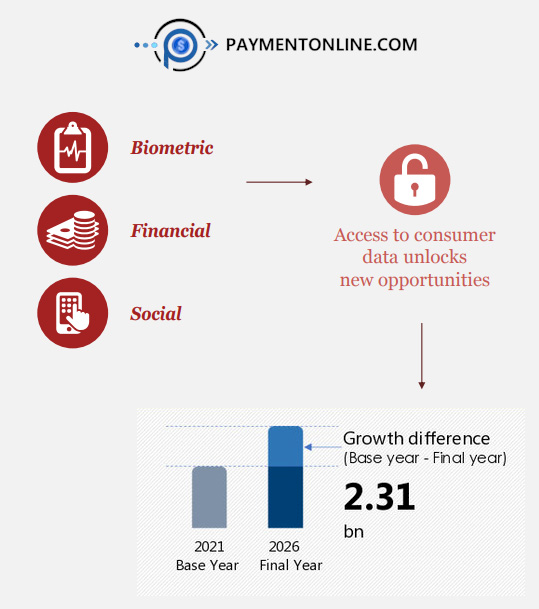

Consumers are already familiar with using biometrics (for instance, finger, face or iris to access smartphones). Now, they're ready to use them for payments over the Internet to making shopping more convenient and secure.

Currently, 86% of consumers are interested in extending the use of biometrics as long as their privacy is respected.

Biometric authentication methods, such as fingerprint recognition, facial recognition, and iris scanning, offer highly secure ways to perform transactions, authorize payments and access ecommerce platforms. They provide a more secure alternative to traditional passwords or PINs, reducing the risk of fraud.

Blockchain technology ensures the ownership and provenance of virtual assets. Users can securely buy, sell, and trade virtual goods, knowing that their digital ownership is transparent and verifiable.

The proliferation of biometric-enabled devices, such as smartphones and tablets, ensures widespread accessibility. Customers can use their devices' built-in biometric sensors for secure and convenient payments.

The metaverse allows retailers to create virtual stores where users can explore products in a 3D environment. Shoppers can interact with products before making a purchase decision, creating a highly immersive shopping experience with the convenience of biometrics for secure and convenient order processing.

In the metaverse, virtual currencies (including cryptocurrencies) and digital assets can be used for transactions. Users can buy virtual goods or even real-world products and services within the metaverse using these digital currencies, fostering a seamless payment ecosystem.

Here at Payment Online, we continue to offer dynamic and innovative payment processing solutions for businesses and individuals and will shortly launch a payment processing integration of biometrics and the metaverse into a single ecommerce and payment processing platform. This, we believe, will set to revolutionize how people shop, pay, and interact online.

This platform will enhance security and convenience but additionally, it will also create immersive, personalized, and socially engaging experiences for consumers, ushering in a new era of digital commerce and integrated secure payment processing.

Evolving Technologies

Future evolving technologies hold immense potential to revolutionize payment processing in ecommerce, offering greater efficiency, security, and customer convenience. Innovations such as blockchain, artificial intelligence, and quantum computing are expected to play pivotal roles.

Blockchain's decentralized and immutable ledger ensures secure, transparent, and tamper-proof transactions, instilling trust between buyers and sellers while reducing fraud. Artificial intelligence-driven systems will provide personalized shopping experiences, optimizing product recommendations and enabling dynamic pricing strategies.

Quantum computing, with its unparalleled computational power, can enhance encryption methods, making online transactions even more secure. Moreover, advancements in biometric authentication, like facial recognition and fingerprint scanning, will offer seamless and highly secure payment processes.

Internet of Things (IoT) devices will continue to enable effortless transactions, allowing customers to make payments using connected appliances and wearables.

As these technologies converge, they are expected to create a robust ecosystem for ecommerce payment processing, ensuring faster, more secure, and personalized transactions for consumers, thereby reshaping the future of online commerce.

1. Blockchain and Payment Processing for eCommerce

Although Blockchain technology was designed primarily for cryptocurrency transactions (such as Bitcoin, Ethereum, Litecoin, etc.) and other cryptocurrency-related purposes, for instance specifically as a public transaction ledger - it has capabilities and usefulness that can be incorporated extensively in the eCommerce industry.

Blockchain technology can significantly contribute to the growth of ecommerce and payment processing by leveraging biometrics security, fraud prevention, faster transactions, lower transaction fees, supply chain transparency, global reach without national government controls, data protection and privacy. Therefore businesses and companies can adopt ecommerce in a very flexible way to enhance their operations, reduce costs, improve security, and provide a better experience for their customers, ultimately fostering growth in the digital shopping and payment processing industry.

Blockchain technology is a revolutionary innovation that enables users to enter time-stamped transactions into an immutable digital ledger that is part of a vast digital network managed by clusters of computers. There is no central authority. The said ledger is digitally shared, enabling everyone with access to see all the information within while being unable to alter the details.

In an eCommerce setting, blockchain technology is used primarily for enhanced product and payment traceability for security and fraud prevention. In fact, there are growing eCommerce integrations built to leverage these capabilities. Blockchain offers a high level of security due to its decentralized nature and cryptographic techniques. It ensures that transactions are secure and cannot be altered, enhancing trust between buyers and sellers.

For ecommerce businesses dealing with physical products, blockchain can be used to create transparent supply chains. This ensures the authenticity of products and allows customers to trace the origin of items they purchase.

Transparent and immutable ledger helps prevent fraud in ecommerce transactions. Once a transaction is recorded, it cannot be changed, reducing the risk of chargebacks and false claims.

Other possible uses of blockchain technology in eCommerce include chargeback fraud protection and prevention, simplified and accelerated card payments, and the decentralization of cross-border trade.

Blockchain enables efficient processing of micropayments, allowing for new business models such as pay-per-use and microtransactions. This can be especially beneficial for content creators and digital goods providers.

Decentralized Marketplaces: Blockchain enables the creation of decentralized marketplaces where buyers and sellers can interact directly without the need for intermediaries. This can reduce costs and increase efficiency in ecommerce transactions.

2. Chatbots for eCommerce and Payment Processing Online

Chatbots are becoming increasingly prevalent in the ecommerce and online payment processing industry due to their ability to enhance customer experience, improve efficiency, offer a more personalized shopping experience, integrae with payment system and streamline various processes.

Most successful online business websites now include chatbots as part of their eCommerce applications, be it for customer support, answering questions on products, and a variety of pre-sales support functions.

Intelligent AI-powered chatbots are slowly becoming prevalent in the eCommerce landscape. As advances in artificial intelligence and natural language processing technology continue, chatbots become smarter and more capable in handling even complex customer interactions. They engage customers in seamless live chat and can provide customer service 24/7.

They are now being extensively used in Social Commerce (or online shopping eCommerce through social media networks).

Chatbots are usually deployed on a business website, either to engage visitors to influence and enhance their shopping experience or to answer questions about products and services.

By far, most businesses use chatbots for customer support functions. Chatbots provide instant, 24/7 customer support without getting tired and can answer frequently asked questions, assist with product inquiries, and help users navigate the ecommerce website.

This instant support enhances customer satisfaction and encourages sales and creates a personalized shopping experience:

Chatbots analyze customer preferences and purchase history to offer personalized product recommendations. By understanding customer needs, chatbots can suggest relevant products, increasing the likelihood of sales. All of this is done in real-time 24 hours a day, for the convenience of the shoppers.

Another very useful function of chatbots is to provide real-time updates on order status, shipping, and delivery saving time for shoppers so they can immediately access the information they need without having to talk to a live operator.

Online payments are automated to facilitate a seamless payment processing by integrating with various payment gateways.

Payment processing can integrate with online payment platforms, allowing users to make payments, transfer money, or pay bills directly within the chat interface. This streamlined process simplifies online payment processing for customers, again leading to customer satisfaction.

Every marketing department wants to receive feedback from their customers. Chatbots can collect feedback from customers about their shopping experience and payment processing and the entire eCommerce experience. This information is valuable for businesses to make improvements and enhance customer satisfaction.

By leveraging chatbots in these ways, ecommerce businesses can enhance user experience, offer language support, conduct data analysis and obtain insights for their marketing department, offer customers discounts and present promotions, increase efficiency, and boost sales, ultimately contributing to the growth of the ecommerce and online payment processing industry and how it is used in online shopping.

3. Personalize Shopping Experience with AI (Artificial Intelligence)

Personalizing the shopping experience with AI involves leveraging machine learning algorithms integrated into an eCommerce shopping cart to tailor interactions, product recommendations, and services to online shoppers based on their preferences, behaviors, and purchase history.

AI can also be utilized to create a personalized shopping experience when someone visits an online store or is involved in social media platform for interactions and engagement, referred to as Social Commerce, currently the fastest growing market in the world..

AI algorithm bots review customer’s profile and information, looking quickly and furiously deep into the data to find relevant insights that can help shape the online shopping journey. This allows segmentation whereby AI can analyze customer data to identify patterns and segment customers based on their preferences, demographics, and buying behavior.

This is what AI is used the most, at the moment, by businesses in order to target specific customer groups with personalized offers and recommendations, leading to a more seamless ordering process, and can optimize marketing campaigns by analyzing customer data and behavior

Customer data can be analyzed to identify patterns and segment customers based on their preferences, demographics, and buying behavior. The AI-powered predictive analytics can forecast customer behavior, such as predicting which products a customer is likely to buy next. This information enables businesses to proactively offer relevant products and promotions.

Additionally, AI can optimize pricing based on various factors like demand, competitor pricing, and customer preferences. Dynamic pricing ensures that customers receive personalized discounts or offers, increasing the likelihood of conversion. This can then be followed by sending personalized follow-up emails or messages after a purchase, expressing gratitude and suggesting related products

AI-driven chatbots and virtual assistants can engage with customers in real-time, specially when it comes to online payment processing and credit card transaction processing. By understanding customer queries and preferences, these chatbots can offer personalized services and assist with the purchasing process.

By harnessing the power of AI in these ways, businesses can deliver highly personalized shopping experiences, leading to increased customer satisfaction, loyalty, and higher conversion rates.

4. Virtual Reality

Virtual reality (VR) technology has the potential to revolutionize payment processing in ecommerce by providing immersive and seamless experiences for customers.

In a VR-powered ecommerce environment, customers can navigate virtual stores, browse products, and visualize items in 3D before making a purchase decision.

When it comes to payment processing, VR can integrate secure and intuitive payment gateways directly into the virtual shopping environment.

Through VR interfaces, users can select products, add them to their virtual shopping carts, and proceed to checkout using gestures or voice commands, making the payment process highly interactive and user-friendly. Moreover, VR can enhance security by incorporating biometric authentication methods, such as facial recognition or fingerprint scanning, ensuring safe and convenient transactions.

This immersive and visually engaging way of conducting payments not only simplifies the buying process but also enhances customer satisfaction, making ecommerce transactions in virtual reality environments both futuristic and efficient.

5. Internet of Things (IoT)

The Internet of Things (IoT) is poised to transform payment processing in ecommerce by creating a seamless and interconnected experience.

IoT devices, such as smart wearables, connected appliances, and RFID tags, can facilitate secure and convenient transactions.

For instance, smart devices equipped with sensors and NFC technology can enable instant payments with a simple tap, eliminating the need for physical cards or cash.

Additionally, IoT devices can collect real-time data on customer preferences and behaviors, allowing ecommerce platforms to offer personalized product recommendations and discounts, thereby enhancing user engagement and increasing sales.

Moreover, IoT-enabled supply chain management ensures accurate inventory levels, preventing overstocking or stockouts, which can affect payment processing and customer satisfaction.

By leveraging IoT, ecommerce businesses can optimize payment processes, enhance customer experiences, and streamline operations, ultimately leading to more efficient and customer-friendly online transactions.

How do you save time, money, and hassle with Biometrics Security in the Metaverse? Integration and outsourcing.

Payment processing security, and lack of it, have serious implications. Biometrics security can be an expensive implementation within your payment processing infrastructure. The key is Integration and outsourcing.

Normally, developing biometics security ecommerce in-house or off-the-shelf requires the purchasing of secure Internet servers, biometics systems and platforms, digital certificates, ecommerce software, back-end databases, monitoring software, security systems, payment gateway platform, and a range of computer and networking hardware.

In addition to the purchase of required software and hardware, there is staffing cost for design, development, management, and maintenance of these complex systems. Individuals with this type of expertise do not come cheap. There is also additional monthly costs of co-location hosting, bandwidth, secure building, and other costs due to delay in development, time-to-market, etc.

Businesses and companies can avoid all the expense associated to the initial costs and ongoing maintenance by using Payment Online's affordable and ready-integrated biometrics ecommerce solutions and services.

Payment Online solutions and services are based on our proven and tested ecommerce platform so that businesses and companies can avoid all the costs associated to developing a complex ecommerce.

You can also avoid spending on high salaried staff maintaining these software, hardware, security, bandwidth, and networking systems. Integration and oursourcing is the key to making the whole process convenient and affordable.

Our technology is compact enough to meet the needs of small businesses without an IT professional or department, yet scalable enough to allow future growth to as far as, a large scale biometics metaverse ecommerce enterprise with an IT department and a professional team of developers building a comprehensive enterprise-level business management system. However, at each step of our clients' growth, they only spend for the modules they need and use, and not more.

Whether you are selling, be it retail goods or virtual goods, for instance selling subscription, membership, shippable goods, downloadable digital goods, or online services, we have put together sensible and hassle-free ecommerce solutions with integrated biometics platforms that make your life a heck of lot easier.

Secure online credit card processing, payment gateway, Internet merchant account, and ecommerce shopping cart software can now be quickly and easily integrated with your website for a Professional-looking, secure, and reliable online payment system.

Payment Online solutions are compact enough to meet the needs of small businesses without an IT professional or department, yet scalable enough to allow future growth to a large scale ecommerce enterprise with an IT department and a professional team of developers building a comprehensive enterprise-level business management system. However, whether our clients need compact or enterprise-level ecommerce, they only pay for the modules they need and use.

The blend of completely biometrics-ready integrated and easy-to-use software and solutions, as well as in-house developed, managed, and supported services, have together made the Payment Online value proposition, simply unbeatable.

We believe in providing reliable and sensible ecommerce solutions without any of the non-sense sometimes you would experience with other companies.

For instance, there is:

| NO Application or cancellation fee |

| NO term contract/commitment |

| NO upgrade fee |

| NO salesperson commission |

| NO marketing to your customers |

| NO hidden charges |

Cost Integration

The pricing for a complete biometrics-ready integrated ecommerce solution for selling online, is more affordable than you think..

Please note that in order to accept credit cards on the Internet, a merchant needs an Internet Merchant Account, as well as a web site and an ecommerce solution that is applicable to their business model - be it shipped goods or virtual goods, or services model.

If you already have an Internet Merchant Account, contact Payment Online and speak to a sales professional and explain that you already have an Internet Merchant Account - and only require the complete integrated software and admin management system integrated into one complete ecommerce solution.

We have described the pricing as thoroughly as possible to avoid any misunderstandings. The repetition below is intended to avoid hidden costs and provide complete clarity on pricing - something that is often rare in the merchant account industry. We like to treat others the way we want to be treated ourselves: with full disclosure and honesty and then you can decide what is the best ecommerce solution for YOU.

Integrated Outsources Solutions |

| Ecommerce Platform Hosted on Cloud |

| Online Credit Card Order Processing |

| Payment Gateway Services |

| Biometrics Platform on Metaverse |

| Integrated Secure Transaction Processing |

| Internet Merchant Account (VISA/MC) |

| American Express Merchant Account |

| Discover Card Merchant Account |

| Setup Fee |

| Transaction Fee |

| Percentage of your Sales/Revenue (%) Fee |

| Application Fee |

| No Term Contract/Commitment |

| No Cancellation Fee |

| No Annual Fee |

| No Per Item/Product Fee |

| Multiple Admin Access |